This is the first blog post in a new collaborative series between early-stage climate VC Amasia and Malk Partners, preeminent advisor to private market investors on impact and ESG.

Introduction

Amasia invests in companies that have the potential to effect large-scale behavior change, and this is reflected in their investment thesis: “the 4 Rs of behavior change.” Large-scale behavior change forms the bedrock of the 4 Rs because it is one of the most direct ways to reduce the harm inflicted on the planet — the latest IPCC report estimates that behavioral change could reduce emissions by 40-70% by 2050. Behavior change is what this essay will refer to as a preventive strategy: Billions of people making trillions of decisions bear immense potential to prevent emissions from being generated, waste being produced, and natural resources being used. Preventive strategies aren’t just good for the climate; consumers and businesses also seem to favor them.

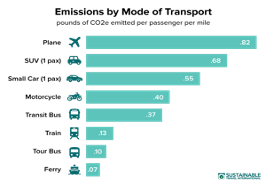

Fig. 1. Opting for train rides instead of flights, and public instead of private transport, have the potential to significantly reduce transportation emissions. Source: Sustainable Travel International

After advising a range of clients in private equity and venture capital on ESG matters, Malk also sees preventive business strategies as appealing to consumers and enterprises. This is reflected in increasing capital allocated towards these solutions. There is a clear commercial incentive to prioritize preventive strategies: Besides being a key lever for combating climate change through mass action, preventive strategies may also present significant business opportunities for enterprises capitalizing on climate solutions.

What are reactive strategies, and why aren’t they enough?

Reactive strategies are the counterpart to preventive strategies, and refer to those that attempt to reduce harm that is already inflicted. Examples include deep tech solutions like carbon capture technology to reduce atmospheric carbon; plastic-eating bacteria to counter rapidly accumulating waste; and stratospheric aerosol injection: introducing small, reflective particles into the upper atmosphere to reflect sunlight before it reaches the surface of the Earth.

While many such innovations have made significant progress in decarbonization, they’re not enough to stave off climate change. As David Biello writes, “without the societal will to decarbonize, even the best technologies won’t be enough”. We do not have enough land, capital, natural resources, margin for error, and, perhaps most critically, time. Scaling proposals for technical carbon removal, for instance, would require 180 Gt of clean water per year, which could deprive 53 million people of water, and cost over $1T annually. Even converting all of the Earth’s cropland to forests to remove CO2 would lower global temperatures by just 0.45°C.

Fig. 2: Carbon capture technology. Source: Clean Air Task Force

At our current rates, we are simply emitting too much carbon for any solely reactive solution to be deployed at the speed and scale necessary to combat climate change.

For these same reasons, Malk Partners expects some degree of hesitancy among asset managers to invest in reactive strategies to climate change, outside of climate-specific investors. Reactive strategies are capital intensive and inherently speculative from a technological point of view, both of which may make them less attractive as business models to traditional investors, outside of a few unicorns. Preventive strategies may provide a less risky avenue for exposure to the rapidly growing climate solutions space.

We also need preventive strategies to tackle the problem at its root

While reactive strategies are valuable, it makes sense to address the source of the problem at its root, rather than just find ways to alleviate the damage. In an ideal world, mankind can sequester all the carbon we release, restore all devastated ecosystems, recycle all our waste, and reverse all our pollution. But until society gets to that point — if it is even possible — humans have to find ways to drastically scale back on our negative environmental impact so that there is less to undo in the first place. And to do this, the world needs preventive strategies.

For Amasia, this specifically means large-scale behavior change. The more society scales back on overconsumption and emissions-heavy behavior, the less pollution will be created and the less environmental degradation will be caused (and have to be undone).

Through ESG diligence and advisory work, Malk has also observed these behavioral trends happening organically in the market. For instance, consumers are increasingly eschewing meat-based diets, at least partly for environmental reasons. In 1994, only 1% of Americans identified as vegetarian or vegan – in 2022, that figure was measured to be as high as 10%. These trends also extend to enterprises, with 39% of U.S. Fortune 500 companies holding at least one tracked GHG reduction initiative. Unsurprisingly, Malk has observed a corresponding increase in sustainability initiatives among corporates and investors alike, with both groups seeking to capitalize on these trends and to expand into rapidly growing sectors.

Apart from being more conscious of their carbon footprint, many companies are leading the way with preventive solutions. By powering reuse systems for food packaging, Amasia’s portfolio company Topanga helps their clients eliminate the need for single-use to-go containers by switching to reusables. This switch is made seamless and convenient for customers, such as students on college campuses, and prevents the use of hundreds of thousands of single-use containers per semester.

Fig. 3: Reusable containers and packaging displace single-use plastic. Source: Unsplash

Similarly, TreeDots helps redistribute imperfect food to customers, creating a market for food products that might otherwise have been discarded. Reducing food wastage can prevent up to 8% of all GHG emissions annually.

There are, of course, other preventive strategies that don’t focus on behavior change, and that require deep tech — decarbonizing construction, for instance, and reducing water waste in clothing production.

Preventive strategies that Amasia invests in take many forms, and ultimately aim to drive environmentally sustainable changes in behavior. This ranges from telehealth and carbon emissions measurement to remote education. Though they might seem disparate, in their own innovative ways, each of these companies presents a strategy that helps to prevent harm to the environment.

For instance, Commons helps users track their carbon footprint using credit card transaction data, and nudges users to make more sustainable lifestyle choices to reduce their footprint. Commons also offers a service to help users offset their unavoidable emissions. By helping customers measure air quality, often for the first time, Clarity raises awareness of air quality and air pollution issues, thereby enabling climate action to reduce emissions.

Conclusion

As the adage goes, prevention is better than the cure – and the climate crisis is the most appropriate and urgent example there is. While reactive solutions help slow down the advancement of climate change and maintain the liveability of our planet, they do not solve the root of the problem. Reactive solutions only buy us time while we implement preventive solutions to change behavior and build social momentum around prioritizing sufficiency, planetary welfare, and regeneration.

Malk Partners does not make any express or implied representation or warranty on any future realization, outcome or risk associated with the content contained in this material. All recommendations contained herein are made as of the date of circulation and based on current ESG standards. Malk is an ESG advisory firm, and nothing in this material should be construed as, nor a substitute for, legal, technical, scientific, risk management, accounting, financial, or any other type of business advice, as the case may be.