In ESG in Private EquitySM – 2015, MSP draws on the primary responses from more than 70 private equity general partners (GPs) and limited partners… Continue Reading

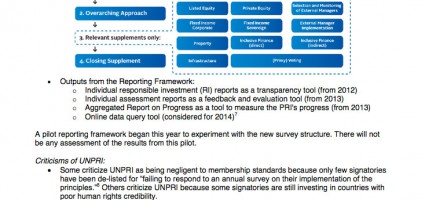

UNPRI Guide for Private Equity Fund Managers

The UN Principles for Responsible Investment (UNPRI) framework will come into effect in 2013. The UNPRI guidelines for responsible investment are gaining increased presence and… Continue Reading

Malk Partners to Moderate ESG Panel at SuperReturn U.S. (June 15th-18th, Boston)

Malk Partner’s Managing Partner, Andrew Malk, is moderating an ESG panel at SuperReturn U.S. 2015, one of the premier private equity events of the summer…. Continue Reading

Malk Partners Featured in Pitchbook’s Annual Private Equity ESG Survey

Today, Pitchbook released its annual Private Equity ESG Survey Report featuring a question and answer with Malk Partner’s Managing Partner, Andrew Malk. The report draws… Continue Reading

ESG in Private Equity℠ – 2014

ESG in Private Equity℠: Issue Focus – 2014 is the first study to take an in-depth look at how large enterprise customers’ supply chain sustainability… Continue Reading

PEI Features Malk Partners as a Leading ESG Expert in its Annual Responsible Investment Special

When PEI’s Annual Responsible Investment Special looked to report on the influence of LP concern for ESG management capabilities among their private equity GPs, they… Continue Reading

Buyouts Magazine Profiles Malk Partners

Need To Meet: Andrew Malk, Managing Partner, Malk Partners Buyouts – September 2 2013 | By Steve Bills As premier buyout firms take more prominent… Continue Reading

Oak Hill Capital Partners Releases its Inaugural ESG Report: A first among U.S.-based middle market private equity firms

October 31, 2013 By: Andrew Malk and Jennifer Pennell Oak Hill recently released its first ESG report, which is particularly notable given that it was… Continue Reading

KKR Releases 3rd Annual ESG Report

By Dana George Earlier this week Kohlberg Kravis & Roberts (KKR) released its third annual ESG report, Creating Sustainable Value: Progress through partnership. KKR began… Continue Reading

Malk Partners Featured in PE Manager

Some private equity firms now consider responsible investment issues across all phases of the investment cycle in a trend that has been well received by… Continue Reading

ESG in Private Equity℠ – 2013

74% of participating private equity general partners (GP) increased their ESG commitments in the previous 12 months. GP action focuses heavily on opportunities to mitigate… Continue Reading

Malk Partners Releases its Second Study: ESG in Private Equity – 2013

(June 10, 2013) – Today, Malk Sustainability Partners (MSP) released ESG in Private Equity – 2013. The study is distinct because it draws on primary source research from extensive conversations with senior members of global private equity general partners (GP) and limited partners (LP) to identify year over year trends in drivers of ESG adoption, communication of management efforts, and organizational structure of responsibilities across the investment cycle.

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- Next Page »