This is the second blog post in a collaborative series between early-stage climate VC Amasia and Malk Partners, preeminent advisor to private market investors on impact and ESG.

Introduction

Amasia invests at the intersection of both purpose and profit. This means that, despite being a single-bottom-line investor, Amasia nevertheless places high importance on generating positive climate impact through their investments.

This blog post serves partly as an update on how Amasia tackles impact and how ESG fits into their thinking. Malk’s input in this essay offers additional insights into Impact and ESG, how they overlap, and common misconceptions.

A Brief Overview of Impact and ESG

Though frequently confused, Impact and ESG are not the same.

ESG refers to the risks and opportunities that arise from the environmental, social, or governance factors within a company’s operations that could influence the company’s performance (e.g., fair wages, GHG reductions, ESG incidents that might result in litigation or public scrutiny) through its impact on a broad range of stakeholders (e.g., employees, customers, society, the planet). Using an ESG framework not only helps investors identify companies that conduct business in a responsible and financially sustainable way, but also helps investors better understand and manage the risks arising from ESG factors within these companies.

Impact, on the other hand, relates to the positive or negative social or environmental changes resulting from the generation, provision, and use of business’ products or services. Impact should be intentional, demonstrable, quantifiable and, at a later stage, verifiable. Positive environmental impact can take the form of greenhouse gas emissions averted, waste reduced, environmental degradation avoided, and so on. Conversely, examples of negative impact include emissions generated, waste produced, and environmental degradation caused.

There are certainly overlaps between Impact and ESG. For instance, if a company’s practices involve deforestation, this would count as a negative impact and potentially be considered a material ESG factor (if this deforestation is deemed material, or financially relevant, to the business).

That said, it’s important to understand the differences between Impact and ESG. The latter refers more to an assessment of how a company manages its material ESG risks and opportunities. For instance, how a company manages its carbon emissions and targets, or how it manages its employees. While an ESG framework may consider a Company’s adverse impact on external stakeholders primarily from a risk management perspective (e.g., avoiding pollution to prevent public scrutiny), the framework would consider positive impact on external stakeholders primarily as an opportunity that is part of an overall investment strategy but is not necessarily central to it. Further, the positive impact would likely only carry significant weight if it had material financial upside. This is opposed to Impact, where the non-financial positive impact of the product or service is more central to the investment decision than in ESG.

In summary, it might be helpful to view Impact as a company’s impact on society and the environment, and ESG as a framework to help investors understand primarily internal environmental, social, and governance factors that impact a business and how the business manages these factors.

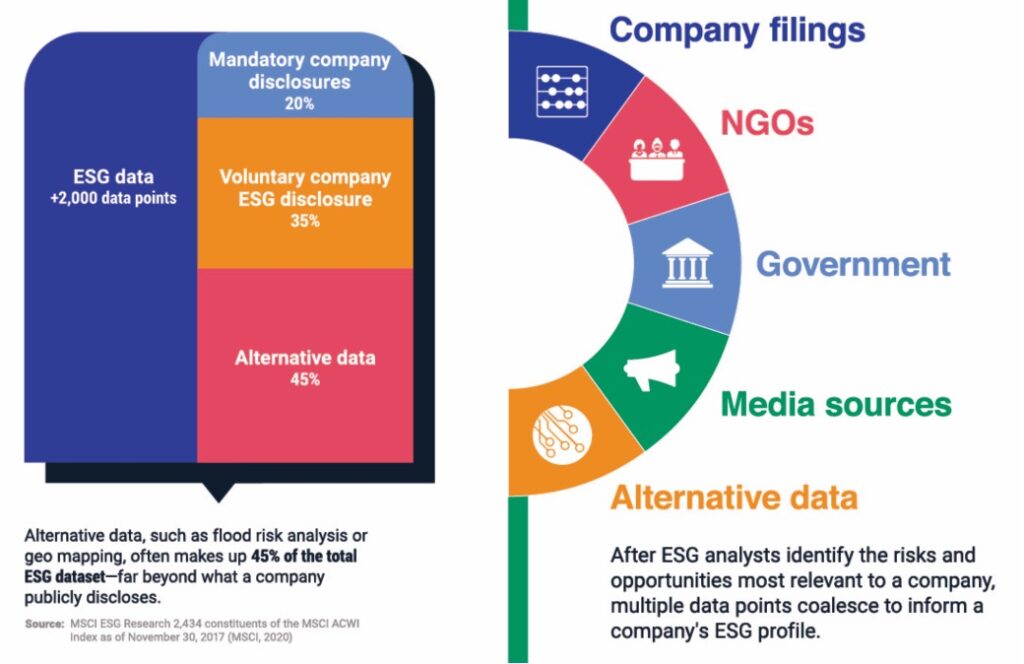

Fig. 1: ESG Profiles Comprise Different Types of Data from Multiple Sources; Source: Visual Capitalist

Challenges & Metric Collection

Both Impact and ESG have their challenges: as is widely acknowledged, ESG has faced challenges as it has evolved and grown increasingly prevalent in the public eye. These challenges include lack of standardization, politicization, limited data availability and transparency from certain data providers. Additionally, there is the risk of greenwashing if ESG principles or activities are leveraged exclusively for promotion rather than true ESG risk mitigation and value creation.

Because ESG is primarily concerned with environmental, social, and governance issues which have material financial risks, it sometimes does not comprehensively address problematic company activities. For example, a company could receive a decent ESG score from certain rating agencies even if it is a significant source of emissions, should the emissions be seen as non-threatening to the company’s financial value (e.g., in a regulatory environment where emissions are not expected to be regulated or a market environment where customer preferences do not incentivize lower-carbon goods and services).

Many of these challenges also apply to impact measurement. Quantifying impact, such as changes in behavior, is tricky and at times not possible. Impact measurement, even more so than ESG, is not standardized across companies, industries and geographies. This makes impact difficult to compare across companies, especially when different metrics are used.

Bearing this in mind, measuring impact and ESG through a qualitative and quantitative lens is critical for understanding impact and ESG performance as well as mitigating ESG risk. As a leading ESG advisory firm, Malk partners has performed ESG diligence on 1000+ companies, with many of them monitored annually thereafter. From the ESG lens, measuring key attributes of a company (e.g., GHG emissions, workforce diversity, employee turnover, number of data incidents, etc.) can help a company understand key areas of ESG risk and opportunity.

In Malk’s experience, companies who measure their ESG performance are better positioned to mitigate ESG risk (e.g., understand drivers of employee turnover) and capture ESG opportunity (e.g, accelerate innovation through a diverse workforce; attract climate conscious customers through GHG reporting), both from the strategic perspective of having this data as a baseline as well as the more tonal perspective of building institutional buy-in for ESG through initial steps of measurement. Measuring impact may be even more important for impact investors, given the centrality of positive social or environmental impacts to the investment thesis.

How Amasia Approaches Impact

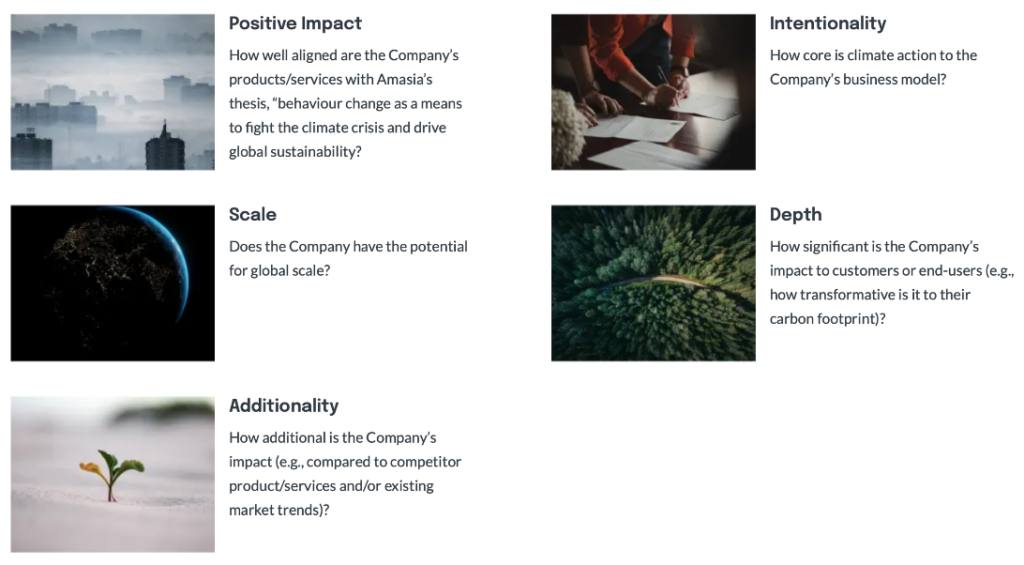

Amasia’s investments are driven by the firm’s thesis, which is built around large-scale behavior change as a means to combat the climate crisis. Each investment is screened for positive climate impact potential, as has been outlined in a previous blog post introducing Amasia’s impact screen. This impact screen was developed in collaboration with Malk and is customized to Amasia’s thesis.

Since publishing that blog post, Amasia has formulated quantitative impact metrics for a number of companies that are tracked on a quarterly basis. An example of this is the amount of imperfect or excess food that its B2B portfolio company, TreeDots, redistributes to users, therefore diverting from landfills.

While quantitative metrics are currently the focus, Amasia is interested in measuring qualitative impact as well; doing so is necessary in order to fully capture the behavior change impact of portfolio companies.

Fig. 2: Amasia’s Impact Screen, Developed in Collaboration with Malk; Source: Amasia

Amasia has historically hesitated to incorporate ESG into the investment decision due to challenges the industry has faced, namely diligence as a “box-checking” exercise if done by investors not seeking true ESG risk mitigation or value creation, or if conducted by third-party providers without rigorous standards; such actors may instead contribute to greenwashing.

However, Amasia still sees the value in assessing ESG risk, particularly when evaluation is done by investors who genuinely see the value of ESG or by third-party providers with rigorous standards and a commitment to ESG principles. Further, while material ESG risks are relevant to all companies, Impact companies have a particular responsibility to manage ESG factors as a risk to their impact potential. For instance, a company creating positive environmental impact through regenerative agriculture may be held to a higher social standard by climate and labor conscious consumers, requiring enhanced attention paid to ESG risks inherent to agriculture (e.g., labor conditions, environmental management, etc.).

Indeed, given the centrality of positive impact to such businesses, protecting against negative externalities is significant to internal and external stakeholders. Internally, employees would react particularly poorly to adverse social/environmental outcomes, given likely incentives for joining an impact-focused company in the first place, and externally, given customers/partners’ enhanced consideration of those same factors.

Of course, ESG doesn’t only matter to impact-focused companies. Traditional business models can protect and create value through ESG principles by engaging workforces positively, preparing for existing and future environmental regulations, and ensuring strong governance practices.

On top of measuring positive climate impact, Amasia engages Malk to conduct ESG risk analyses for certain companies. Malk directly engages with the company to do this. The ESG risk assessment allows both Amasia and the company to better understand which areas of the business present particular challenges. Such assessments ensure that ESG risks are identified and addressed in order to avoid compromising the positive impact made by the company, which is particularly important for impact-based companies, as noted above, given their perhaps increased susceptibility to ESG-based scrutiny.

Bottom Line

Both Impact and ESG can be helpful in assessing a company’s challenges, internal practices, and positive contribution.

Malk Partners does not make any express or implied representation or warranty on any future realization, outcome or risk associated with the content contained in this material. All recommendations contained herein are made as of the date of circulation and based on current ESG standards. Malk is an ESG advisory firm, and nothing in this material should be construed as, nor a substitute for, legal, technical, scientific, risk management, accounting, financial, or any other type of business advice, as the case may be.