Key Takeaways

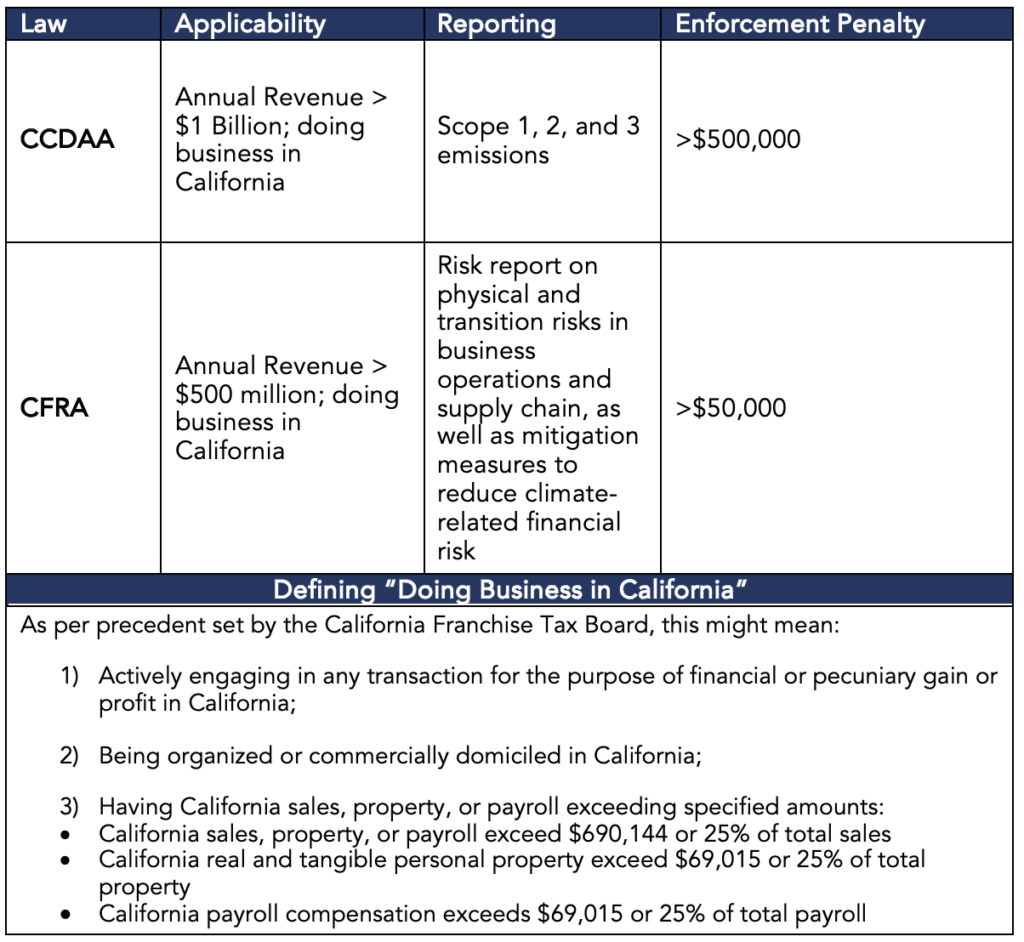

- California’s landmark climate disclosure legislation, including the Climate Corporate Data Accountability Act (CCDAA) and Climate-Related Financial Risk Act (CFRA), extends climate reporting requirements to both public and private companies, setting a precedent for comprehensive emissions tracking and financial risk assessment in the United States.

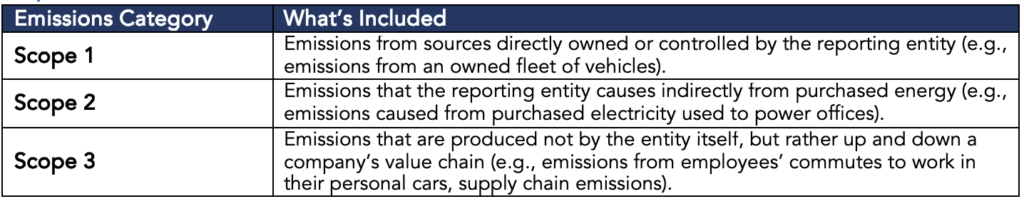

- Covered companies must prepare for the forthcoming reporting obligations, which will include reporting on all three categories of greenhouse gas emissions (Scope 1, 2, and 3) and providing detailed risk reports related to climate change and risk mitigation plans. The legislation represents a significant shift toward greater corporate accountability for climate-related impacts.

Landmark Legislation

The California Legislature recently passed two landmark climate disclosure bills with the potential to alter the landscape of corporate climate accountability in the US for the foreseeable future; the bills were subsequently signed by California governor Gavin Newsom in early October. California’s new rules go well beyond the SEC’s proposed corporate climate disclosure rules, as they apply to both public and private businesses, and extend emissions reporting to include all three categories of GHG emissions. As a state with the fifth largest economy by GDP globally, California has often been the standard-bearer on environmental issues, leading the way for domestic efforts in fast-tracking emissions reduction initiatives and setting ambitious goals for electrification. It does not come as a surprise that the California bills are so far-reaching and will inform disclosures for companies around the world. Consequently, the largest companies operating within the United States will be required to disclose their emissions data, owing to the vital role that California sales play for these corporations.

Climate Corporate Data Accountability Act (CCDAA)

The Climate Corporate Data Accountability Act (CCDAA) applies to companies with annual revenues exceeding $1 billion that also operate in California – see applicability and enforcement section for clarification. It mandates these companies to report their direct and indirect greenhouse gas (GHG) emissions commencing in 2026 and 2027, with subsequent annual reporting thereafter. Covered businesses will be required to disclose Scope 1 (direct emissions), Scope 2 (emissions associated with electricity consumption) and Scope 3 (indirect, value chain emissions) in conformance with Greenhouse Gas Protocol standards and guidance.

Climate-Related Financial Risk Act (CFRA)

The Climate-Related Financial Risk Act (CFRA) requires companies generating $500 million or more that also conduct business in California (see applicability and enforcement section for clarification) to report on their financial risk related to climate change as well as plans for risk mitigation. This risk report must be in-line with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD), and therefore should include both physical and transition risks in corporate operations and the supply chain, as well as corresponding measures taken to reduce and adapt to climate-related financial risk. However, emissions tracking is not required under the CFRA, and only falls under the purview of CCDAA.

Applicability and Enforcement

One of the sponsors of the CCDAA, Scott Wiener, indicated that the CCDAA’s revenue threshold would capture approximately 5,400 applicable reporting entities; given the CRFRA’s lower revenue threshold, it’s likely that thousands more will fall into its purview. While the language of both laws states that requirements are applicable to companies “doing business in California,” this language is vague and not clearly defined. Yet, in other statutes such as the California revenue and tax code, the phrase is defined expansively to include actively engaging in any transaction for the purpose of financial or pecuniary gain or profit in California; being organized or commercially domiciled in California; or having California sales, property, or payroll exceeding specified amounts. Therefore, given the broad scope of applicability, major corporations should begin to assess their scope of operations to determine whether they engage in business operations within the state, and thus fall under the purview of the climate disclosure rules.

Companies will be required to file reports with the California Air Resources (CARB), a department within California’s Environmental Protection Agency. Moreover, CARB will provide further detail to come on whether the above definition of conducting business in California will be used, or if an alternative revenue threshold will be instituted. However, based on the aforementioned existing standards, the threshold could be rather low. As far as enforcement mechanisms, CARB is tasked with levying associated administrative penalties for non-filing, late filing, or other failures to meet the requirements of both laws; penalties for the CCDAA are not to exceed $500,000 and $50,000 for the CFRA.

Overlap with CSRD

While public companies have been preparing for the SEC’s final rule, expected in Q4 of this year, private companies in the US are not typically accustomed to mandatory disclosures of any kind. The California rules more closely approximate the European Union’s Corporate Sustainability Reporting Directive (CSRD), which requires reporting on sustainability considerations such as Scope 3 emissions, has a lower revenue threshold, and applies to the subsidiaries of non-EU companies. While Scope 3 emissions were included in the SEC’s original proposal, it is unclear whether the final rule will include such emissions, as they have become highly politicized in Congress and among industry groups. As per the CCDAA, a reporting entity can submit emissions reports prepared for the purposes of meeting other national or international reporting requirements, as long as those reports satisfy all of the CCDAA’s requirements, in which case companies that disclose emissions data under CSRD may be able to submit the same report to satisfy CCDAA requirements. Therefore, large companies may be able to leverage the groundwork already done for in preparation for CSRD to ensure compliance with the California rules.

Timeline

Reporting for Scope 1 and 2 emissions under CCDAA will begin in 2026 for 2025 Fiscal Year emissions, while disclosure of Scope 3 emissions will follow in 2027 for 2026 Fiscal Year emissions. Applicable businesses will therefore need to track their Scope 1 and 2 emissions beginning in 2025, as well as Scope 3 in 2026 on an annual basis thereafter. Moreover, the bill clarifies that companies’ Scope 1 and 2 emissions must be audited by independent verifiers at a limited assurance level beginning in 2026, and at a reasonable assurance level beginning in 2030. Limited assurance may require external validation and verification of emissions from a third party, increasing demand for third party carbon accounting service providers; implementation of reasonable assurance in 2030, will necessitate robust, auditable emissions reports that require more extensive testing, data verification and evaluation of methods, further increasing demand for external carbon accounting services. Under the CFRA, climate-related financial risk reports are due on January 1st, 2026, and biennially thereafter.

In the meantime, CARB is tasked with adopting regulations to implement the reporting program by January 1, 2025, issuing disclosure requirements based on the GHG Protocol Corporate Accounting and Reporting Standard and the GHG Protocol Corporate Value Chain (Scope 3) Accounting and Reporting Standard, which defines parts of a company’s operations are relevant in GHG reporting. This will likely require a lengthy public notice-and-comment process, similar to the SEC’s climate proposal. CARB is also tasked with preparing a biennial public report which reviews climate-related financial risk disclosures by industry and analyzes systematic and sector-wide climate-related financial risks facing the state, including potential impacts on economically vulnerable communities.

Signaling that there are still details to be ironed out and further modifications possible, Newsom issued statements indicating uncertainty regarding the rules’ intended timeline and execution. Wary of the CCDAA timeline, Newsom warned that the bill’s implementation deadlines were not feasible, and that the GHG reporting protocol could result in inconsistent reporting across businesses, possibly due to different understandings of what falls under the range of Scope 3 emissions. On the CFRA, he cautioned that the implementation deadline failed to allow CARB sufficient time to carry out the requirements of the bill, in its duties to implement and create reporting processes as prescribed through the law.

While private companies in the US have not been subject to legislative requirements relating to climate disclosure, corporate support has been growing, as 50% of the largest 1000 public companies in the United States reported GHG emissions in 2022, with larger companies disclosing about three times as many environmental metrics as the smallest companies. More than half of S&P 500 companies disclose climate risks in annual reports, while 71% disclose GHG emissions. Moreover, the rules have been endorsed by more than a dozen corporations, including Microsoft, Apple, Salesforce, and Patagonia.

Scope 1, 2, and 3 Emissions

Companies within the parameters of the rules will be required to report the full scope of their emissions associated with the corporate value-chain, including Scope 1 (direct emissions from assets or sources owned by a Company) and Scope 2 (indirect GHG emissions associated with the purchase of electricity, steam, heat, or cooling). Going forward, Companies will be also responsible for laying the groundwork to track Scope 3 emissions, which are generally heavily underreported, but almost always represent the largest source of GHG emissions. They can be difficult to quantify, given reliance on data outside a Company’s purview, but can represent up to 70% of a business’ total emissions. Nonetheless, the CCDAA offers a degree of flexibility as it relates to Scope 3 calculations, allowing companies to rely on secondary data including industry averages. The Scope 3 Standard (as per GHG Protocol) divides Scope 3 emissions into upstream and downstream emissions and categorizes both into 15 distinct categories. Reporting Companies will be required to disclose Scope 3 emissions per category, in addition to including the percentage of emissions calculated using data obtained from suppliers or other value chain partners. Given the practical challenge of expecting all relevant suppliers to furnish GHG inventory data, companies should actively promote the development of GHG inventories among their suppliers. As such, covered companies should begin to prepare for the new disclosure regime, including defining their own emissions profile and those of their value chain. They will need to adopt and maintain a risk-based approach to climate governance, necessitating continuous evaluation of climate-related risks affecting business-line operations.

How Malk Can Help

In the private markets, the California climate disclosure laws will require private companies to disclose their own emissions profiles in the US. With the advent of CSRD in Europe, Companies with much lower revenues and headcounts will be required to report on their Scope 1 through 3 emissions. In order to gauge their climate transition exposure, begin carbon tracking, and eventually, reduction strategies, companies must meticulously identify and appraise the risks associated with their assets, track advancements toward decarbonization objectives, and communicate their climate strategy effectively to both investors and regulators. Achieving this necessitates a thorough due diligence process and support to ensure alignment with pertinent reporting standards. Malk offers both investors and companies the tools to identify climate-related risks through comprehensive due diligence and aids in assessing progress towards decarbonization targets via carbon accounting and framework alignment.

Malk Partners does not make any express or implied representation or warranty on any future realization, outcome or risk associated with the content contained in this material. All recommendations contained herein are made as of the date of circulation and based on current ESG standards. Malk is an ESG advisory firm, and nothing in this material should be construed as, nor a substitute for, legal, technical, scientific, risk management, accounting, financial, or any other type of business advice, as the case may be.