Key Takeaways

- UN PRI’s 2024 reporting cycle opens May 2nd.

- In preparation, Malk has created an overview to discuss changes to the content and processes, tips for reporting, and how Malk can help.

- The most significant changes UN PRI has made relate to who must report and the timeline for reporting, with minimal changes to the modules themselves.

Who Has to Report in UN PRI’s 2024 Reporting Cycle

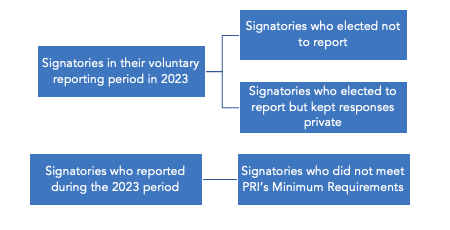

UN PRI has adjusted who needs to report in 2024 to ease the burden on signatories who publicly reported in 2023 and met all minimum requirements. This change applies to the 2024 reporting cycle only; UN PRI has not yet confirmed what reporting requirements will look like for 2025 and beyond.

In 2024, the following signatories must report:

In 2024, the following signatories do not need to report:

The UN PRI has Minimum Requirements that all signatories must meet or they will be submitted to the PRI board for delisting. Signatories must have a responsible investment policy, senior-level oversight for responsible investment implementation, and at least one person whose role includes responsibility of implementing responsible investment in their organizations.

Updated Timeline for UN PRI 2024 Reporting Cycle

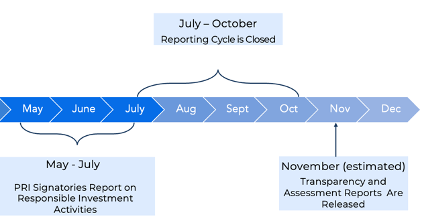

The UN PRI reporting cycle is beginning earlier in 2024 than it did in 2023. The reporting cycle will open on May 2nd and close on July 26th. UN PRI predicts it will release Transparency Reports and Assessment Reports in November 2024.

UN PRI Reporting Modules

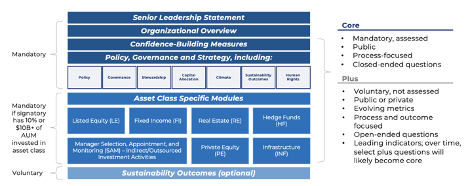

There is a set of modules that all signatories must complete: Senior Leadership Statement, Organizational Overview, Confidence-Building Measures, and Policy, Governance, and Strategy. If a signatory has 10%+ of its AUM or $10B+ of AUM invested in an asset class, it must report on the asset class specific modules.

Within these modules, there are “Core” questions, which are mandatory, contribute to the signatory’s score, and are published in public reports. There are also “Plus” questions that signatories can choose to respond to; the signatory can choose whether these answers are public or private, and these questions do not contribute to the signatory’s score. “Plus” questions can be helpful to provide investors and the public further context on the signatory’s responsible investment program.

Approximately 90% of the 257 module indicators will remain the same as 2023, with updates to just 29 indicators. Most of the changes are stylistic in nature to alleviate some of the ambiguity that existed last year, and the content has not changed significantly. The modules with adjusted indicators are Organizational Overview (7), Policy, Governance, and Strategy (16), Manager Selection, Appointment, and Monitoring (2), Real Estate (1), Infrastructure (1), and Sustainability Outcomes (2).

Navigating Reporting

Signatories should begin by ensuring internal stakeholders are aligned on their role in reporting. Malk sees the following roles as the most involved in UN PRI reporting.

- ESG Committee/Lead typically has insight into various aspects of the ESG program, but will require validation from additional stakeholders (e.g., Finance, Compliance) on several responses.

- Compliance/Legal leaders will likely have the highest time commitment and would be responsible for a significant portion of responses, particularly related to internal policies and voting obligations.

- Investment Team will be most involved in the asset class modules, answering questions related to ESG diligence and monitoring. They will also be able to contribute to related questions in Policy, Governance, and Strategy.

- Investor Relations may have insight into voting obligations and ESG communication but will have limited responsibility in answering questions.

- Finance Team will help mostly with organizational overview questions, particularly regarding AUM.

Signatories should align on which modules they are responsible for completing and determine which stakeholder is most appropriate to start answering which modules. Stakeholders should remain in constant communication with each other, flagging when there are questions that other stakeholders are better positioned to answer. At the end, Compliance should review all indicators to ensure answers align with the Firm’s program in practice and comply with regulatory expectations – internal review will also help improve the Confidence-Building Measures score.

PRI can be difficult to navigate, and the terms used in the questions can be ambiguous, but PRI provides resources that can help with answering each module. For example, PRI has a glossary of technical language used throughout the modules and provides guides, such as the Stewardship in Private Equity guide, that share further detail on a responsible investment topic. Signatories should be sure to reference these throughout reporting to ensure alignment with PRI definitions and expectations.

How Malk Can Help

Malk works with GPs to prepare for reporting, implement score improvement initiatives, and complete reporting. Our Gap Assessments include a review of the GP’s ESG program to identify areas for improvement and initiatives the GP can implement to strengthen its ESG program and PRI scores. In our Reporting Support, we help the GP complete each module, leveraging our expertise around UN PRI expectations, acceptable answers, and score optimization. We can also help draft and iterate on the Senior Leadership Statement and other written responses.

Once reports have been released, Malk works with GPs to assess their score to identify high-level areas for improvement and provide GPs with recommendations to increase their score for the following year.

Reporting in 2024 and curious about how Malk can support? Please reach out to Sara Healy at shealy@malk.com.