Key Takeaways

- The 28th COP summit included both a stark assessment of global climate progress and the development of landmark new agreements for climate action, underscoring the consensus that greater climate change mitigation and adaptation actions are urgently needed.

- The first Global Stocktake, an assessment of progress towards the Paris Agreement’s goals for limiting climate change, resulted in a historic agreement by 198 countries on eight global energy transition efforts, including a transition away from fossil fuels for the first time.

- COP28 featured a focus on “fixing climate finance,” and the summit saw both new and renewed commitments to climate finance funds to prepare for and respond to extreme weather events.

- Momentum for climate-focused capital deployment and private market climate impact funds has accelerated following COP28’s commitments, underscoring opportunities for investors to tap into capital earmarked for climate action.

COP28 Conference Overview

The latest UN climate summit, COP28 (28th Conference of the Parties to the UN Framework Convention on Climate Change), came to a close on December 13th after two weeks of deliberation in Dubai. COP summits have been convened annually by governments since the signing of the first global-warming agreement by the U.N. in 1992, with the COP representing the decision-making body of all 198 countries that are parties to the United Nations Framework on Climate Change (UNFCCC). The intended purpose of COP is for UN member states to review global progress towards limiting climate change, including national greenhouse gas (GHG) emissions inventories, and to form corresponding international agreements, often with the goal of refining targets, forming binding treaties, and outlining climate action plans.

167 heads of state, UN member state delegations, and key private sector stakeholders convened for COP28 at a critical moment at the end of the warmest year on record. Global temperatures, greenhouse gas emissions, and sea levels all reached record highs in 2023, fueling unparalleled levels of climate hazards including wildfires, tropical storms, flooding, and other extreme weather events (EWEs) across the globe. In the U.S. alone, 2023 marked the worst year on record for billion-dollar climate disasters, posing an enormous economic burden for communities and authorities and emphasizing the high stakes for climate action plans and global decarbonization efforts.

Leaders at COP28 stressed that while the Paris Agreement has catalyzed ambitious climate action and energy transition progress by many member nations and private sector stakeholders, global efforts remain off track to limit warming to Paris Agreement targets of 1.5 degrees Celsius above pre-industrial levels. Consensus from the conference found that to keep Paris Agreement targets within reach and achieve peaking and subsequent decline of global GHG emissions as soon as possible, the next round of Nationally Determined Contributions

(NDCs; country-specific climate pledges detailing climate change action plans) must be more ambitious and comprehensive. Conference delegates also stressed the urgent need to strengthen adaptation actions at scale to climate change impacts, with much of the debate centering on addressing the climate finance gap to support developing nations facing the most acute climate risks and preparing National Adaptation Plans (NAPs).

Spotlight: First Global Stocktake of Climate Progress

The landmark first Global Stocktake (GST), a process held every five years to assess progress towards the Paris Agreement’s climate goals, was the central focus of COP28. The GST provides a mechanism for countries and international stakeholders to collectively assess their progress towards shared climate goals formalized in previous climate summits, most notably the 2015 Paris Agreement treaty. The GST assessments and final GST agreement will inform climate action plans and financial commitments, including the next round of NDCs and NAPs, Paris Agreement signatories’ national climate pledges, which will be submitted in 2025.

In advance of the GST, a two-year assessment of global climate progress was conducted by the UN Framework Convention on Climate Change (UNFCCC), culminating in two key reports: a ‘synthesis report’ designed to help countries reach a decision on the course of future global climate action at COP 28 and an extended ‘technical review’, the most extensive assessment of climate action to date. Per the UN, the two GST reports offer a “stark assessment of the current state of global climate action and the urgent need to increase efforts to meet the goals of the Paris Agreement,” highlighting the critical importance of the conference to align stakeholders on climate actions. The synthesis report shared that to achieve Paris Agreement targets, GHG emissions need to be cut approximately 43% by 2030 and 60% by 2035 from 2019 levels.

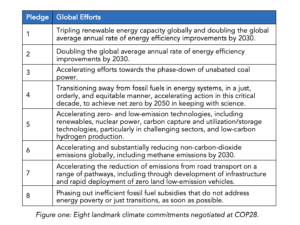

The COP28 conference served as the culmination of the GST process, with Parties to the UNFCCC debating the next set of global efforts and climate action plans in the final GST text, one of the most significant and fiercely contested agreements at COP28. The GST agreement’s final text highlights key vulnerabilities in the global energy transition and calls for stakeholders to accelerate emissions reductions globally. The landmark agreement outlines a core set of eight ambitious climate pledges that Parties agreed upon at COP28. These critical Party commitments to collective efforts will guide international climate commitments and energy transition financing in the coming years and represent a key output of the summit.

Earlier drafts of the GST text’s commitments included more ambitious decarbonization efforts and energy transition commitments, however, the final text’s commitments featured somewhat diluted language due to resistance by major fossil fuel producers and lobbying by O&G delegates at the conference. Following much deliberation and lobbying, “phase-out” language was adjusted to “transition” efforts for emissions-intensive fuel sources, and global efforts were pushed to focus on reducing GHG emissions rather than fossil fuels explicitly. Despite the debate on what rhetoric to include in the GST agreement, the UNFCCC reports and global scientific consensus remain clear that fossil fuel production and usage must decrease considerably to meet climate goals and mitigate catastrophic global climate change outcomes.

While the final text contained limited explicit mention of fossil fuels, international agreements at previous COPs have previously refrained from mentioning fossil fuels directly, making the agreement by nearly 200 countries to pursue the fourth goal of “transitioning away from fossil fuels in energy systems, in a just, orderly, and equitable manner in this critical decade” one of the most fiercely debated and landmark results of the conference. The GST text marks the first time a U.N. climate agreement has explicitly called for governments to cut back on all fossil fuels, reflecting a renewed commitment from global member states to reduce reliance on the fuel sources driving climate change by 2030.

Spotlight: Climate Finance Progress

One of four overarching pillars of the COP28 summit was “fixing climate finance,” and the conference included a number of new and renewed commitments to climate finance funds from previous COPs, including the Green Climate Fund, Adaptation Fund, Least Developed Countries Fund, and Special Climate Change Fund. In response to the high demand for climate mitigation and adaptation financing among developing nations, COP28 also saw the development of a new Joint Declaration on Credit Enhancement of Sustainability-Linked Sovereign Financing for Nature & Climate by major multilateral development banks (e.g., Asian Development Bank, African Development Bank, European Investment Bank, United States International Development Finance Corporation) and existing climate funds (e.g., Green Climate Fund, Global Environment Facility).

A crucial climate finance outcome of the summit was an agreement by delegates on a new collective quantified goal (NCQG) at COP28, building on the 2009 commitment from developed nations to pledge $100 billion annually to finance climate mitigation and adaptation goals established at COP15. Previous summits, most notably COP26 in 2021, urged developed nations to increase their climate finance contributions to UN climate finance funds for developing nations in order to meet the initial NCQG target and close the climate finance gap. Notably, the NCGW was likely met for the first time in 2023, as wealthy nations supported developing countries with over $100 billion in climate-related financing. In recognition of the mounting cost of climate mitigation and adaptation, COP28 saw a second landmark agreement to draft an additional post-2025 finance target over the course of the next year in advance of COP29.

A major milestone of COP28 was the establishment of a Loss and Damage Fund to assist developing countries that are particularly vulnerable to the adverse effects of climate change respond to adverse climate impacts that cannot be directly mitigated or adapted to (e.g., storms and floods, reduced agricultural productivity, and rising sea levels). Through the Loss and Damage Fund, Parties contribute grant-based assistance to developing countries and small island states that face the greatest challenges in coping with the repercussions of EWEs. First outlined at COP27, the establishment of a global Loss and Damage Fund was one of the major breakthroughs of COP28, to support countries in responding to the impacts of climate change which have wrought nearly $2 trillion in damages over the past 20 years. Countries including the UAE ($100 million), Germany (£100 million), and the UK (£40 million) led initial contributions, which totaled $650 million by the end of the conference.

Opportunities for Private Market Investors

Private market investors seeking to raise funds for renewables and energy transition strategies stand to benefit significantly from major commitments to accelerate the decarbonization of the energy sector at COP 28, including the landmark Global Renewables and Energy Efficiency Pledge. Endorsed by 130 national governments, the Pledge stipulates that signatories commit to work together to triple the world’s installed renewable energy generation capacity to at least 11,000 GW by 2030 and to collectively double the global average annual rate of energy efficiency innovation. COP 28’s landmark commitments to energy transition investments provide an opportunity for private market investors to benefit from the projected influx of institutional investments into renewable energy assets and energy transition technologies.

Momentum for national climate pledges to offer capital-raising opportunities for investment managers with energy transition and climate-focused funds is exemplified by new commitments such as the Altérra investment fund launched at COP28. The Altérra fund, the world’s largest private climate fund, has already committed $6 billion to alternative climate investments managed by private market GPs in its initial distributions, including the largest ever single LP commitment to an impact fund. Capital allocations earmarked by signatories for renewables assets and energy efficiency technology are projected to increase significantly, and fund managers should ensure they can meet LP criteria in impact and energy transition fund construction to successfully raise capital.

As governments commit additional funding for climate finance initiatives, and major banks earmark trillions for sustainable finance products, private markets are set to witness an unprecedented influx of capital, with an emphasis on emerging markets and developing economies. Accelerated efforts to shift towards a low-carbon economy will require billions in climate financing directed towards sectors such as renewable energy, energy storage, energy infrastructure, transportation electrification, and climate-smart agriculture. COP 28 commitments made are poised to translate into incentives and capital allocations in a multisectoral approach to climate action, accelerating capital deployment and fund-raising opportunities for private market investment managers with progressive climate strategies.

Investment managers and corporates can partner with Malk to develop bespoke, actionable strategies to capture value from the landmark decisions at COP28 and corresponding investments in climate action and the energy transition. From climate impact fund construction and capital raising to energy transition strategies for carbon-intensive portfolio assets, Malk Partners’ deep climate expertise, private market experience, and leading advisory services make the firm an ideal partner for climate action.

Malk Partners does not make any express or implied representation or warranty on any future realization, outcome or risk associated with the content contained in this material. All recommendations contained herein are made as of the date of circulation and based on current ESG standards. Malk is an ESG advisory firm, and nothing in this material should be construed as, nor a substitute for, legal, technical, scientific, risk management, accounting, financial, or any other type of business advice, as the case may be.