Key Takeaways

- The ISSB developed a voluntary sustainability and climate risk disclosure framework, IFRS S1 and IFRS S2, which will go into effect in January 2024. The new standards build on pre-existing frameworks to create a more comprehensive set of disclosures that consider industry-specific sustainability and climate risks. The framework aims to further standardize ESG reporting requirements and create consistent, verifiable information for investment decision-making. The ISSB will solicit stakeholder feedback throughout 2023 regarding future areas of prioritization, and thus the standards could evolve.

- Under the guidelines, a firm’s industry- and climate-specific disclosures are intended to be presented alongside annual financial statements. However, committing to ISSB disclosures would require significant effort for companies and general partners (GPs) with immature ESG programs, particularly those that do not collect robust sustainability data from portfolio companies and do not plan to.

- Though regulatory bodies in the U.S. and E.U. do not yet have plans to formally adopt ISSB disclosure standards, regulatory bodies in other countries (e.g., U.K., Canada, Japan, Singapore) have indicated plans to do so. As such, U.S.- and E.U.-based GPs are likely to receive inquiries regarding the standards and should ensure they can respond comprehensively to limited partners’ (LPs) questions. General partners must carefully assess whether their prior commitments and regulatory requirements align to IFRS standards and their portfolios’ needs.

Overview

The International Finance Reporting Standards’ (IFRS) International Sustainability Standards Board (ISSB) has released new sustainability disclosure standards aimed at streamlining and consolidating sustainability reporting requirements. The IFRS is an independent body that formed the ISSB to develop standards for sustainability disclosures. The new standards integrate several industry-leading reporting frameworks, such as the Task Force on Climate-Related Financial Disclosures (TCFD), International Integrated Reporting Council (IIRC), Sustainability Accounting Standards Board (SASB), and Climate Disclosure Standards Board (CDSB). Additionally, the IFRS has assumed responsibilities from the TCFD for monitoring climate disclosures.

Benefits of ISSB

Companies in private markets face various emerging sustainability disclosure requirements, which have been implemented in piecemeal fashion across industries and geographies. The ISSB is a global framework that incorporates different sustainability disclosure frameworks into a more comprehensive option. For companies and GPs facing pressures to elaborate their internal sustainability practices and efforts to mitigate negative sustainability externalities, the ISSB may provide an effective option. The IFRS standards can provide a globally recognized framework for GPs’ portfolio companies to disclose sustainability and climate information alongside financial information, harmonizing the two types of disclosures.

The ISSB focuses on risks that materially impact a company’s financial performance, which is a particular concern across all private asset classes. It asks companies to report on information which is “reasonable and supportable,” and right-sizes required effort to the size of the company. The concept of “reasonable and supportable information” has been defined by the International Accounting Standards Board (IASB) as information that is accessible without “undue cost and effort.”

Companies can tailor their disclosures under the ISSB requirements based on their business models and levels of capacity, rather than be required to invest significant additional resources into clearing a high, predetermined bar for sustainability disclosure. Tailored approaches to data disclosures may make aligning more feasible for smaller portfolio companies by simplifying the types of data to collect and reducing the burden of collection.

The ISSB also acknowledges difficulties in sourcing data for companies with limited resources and has exemptions for companies to allow for qualitative reporting on certain disclosures. Exemptions are in-line with the “reasonable and supportable” standard and represent areas where the ISSB has determined a company cannot collect quantifiable data without incurring undue cost, such as by lacking an ability to verify collected information. Limited partners evaluating such disclosures from GPs’ portfolios may have a more streamlined understanding of what portfolio companies currently disclose, what they chose not to disclose, and whether companies and GPs are diverging from what they could reasonably be expected to disclose.

Proposed ISSB Disclosure Requirements

General Information

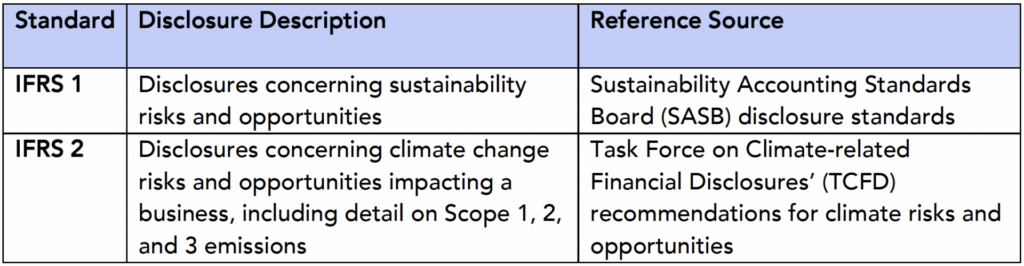

The disclosure requirements comprise two categories (IFRS 1 and IFRS 2), which cover different elements of sustainability reporting and come into effect in January 2024. Companies must report in alignment with both standards to achieve compliance. IFRS disclosures must be released alongside financial statements to underscore linkages between sustainability, climate risk mitigation, and financial performance.

Additionally, IFRS guidance includes transition relief in the first year of application to allow time for companies to collect relevant data. It allows companies to complete disclosures without reporting on certain items, including sustainability risks and opportunities outside of climate, reporting ISSB disclosures in tandem with financial statements, Scope 3 disclosures, use of the greenhouse gas (GHG) protocol to measure emissions, and disclosure of comparative information.

IFRS Standard 1

IFRS Standard 1 primarily covers sustainability risks and opportunities that could impact companies’ future financial performances. Unlike other disclosure frameworks, companies are only required to report on sustainability risks that could impact their cash flow over time. Disclosures for IFRS S1 are based on the Sustainability Accounting Standards Board (SASB) disclosure standards, which are industry-specific and provide guidance on specific sustainability metrics relevant to SASB’s 77 industries. Companies can use SASB to search disclosure standards based on their industry and receive detailed guidance on definitions of metrics and categorizations of risk. SASB offers downloadable, industry-specific primers that can jumpstart disclosures.

IFRS Standard 2

IFRS Standard 2 covers disclosures on climate risks and opportunities. Disclosures must cover both physical risk and transition risk. Physical risk encompasses business disruption or asset damage related to environmental changes triggered or worsened by climate change; transition risk encompasses risk to business performance related to society’s transition to a low-carbon economy. Standard 2 specifically incorporates the Task Force on Climate-related Financial Disclosures’ (TCFD) recommendations for climate risks and opportunities.

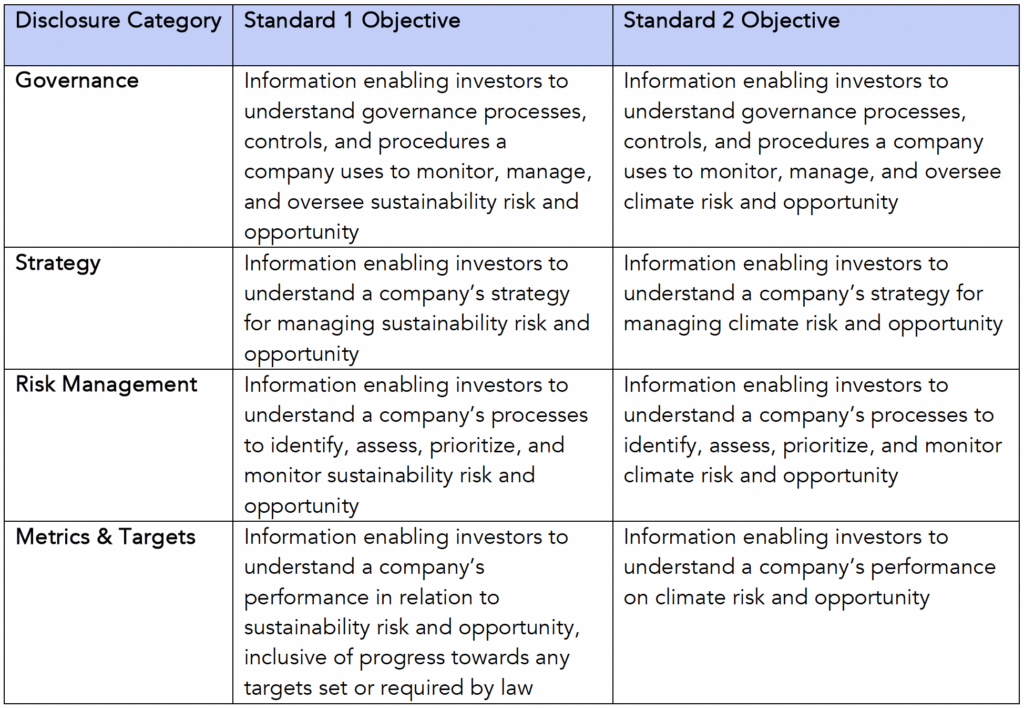

Comparing Standards 1 and 2

Together, Standards 1 and 2 require companies to report information on the following four categories, as they relate to both sustainability and climate risks and opportunities.

Reporting

Requirements for disclosures include:

- A direct statement verifying that the company complies with ISSB standards

- Disclosure of any potential errors or reservations in compliance

- Potential commercial impacts of identified sustainability risks

The current standards do not appear to include a specific form of templated questions companies will be responsible for completing. However, the ISSB provides illustrative, hypothetical examples of how to apply the standards within its accompanying guidance documentation.

The ISSB has also developed a Proposed IFRS Sustainability Disclosure Taxonomy. When approved, the Taxonomy would provide more transparent guidelines for tagging the sustainability disclosures required within financial statements and reports. Adoption would provide further guidance on classifying and structuring information in financial statements.

Implications Across Geographies

Market Impacts in the U.S. and E.U.

While regulatory bodies in some countries (e.g., U.K., Canada, Japan, Singapore) have indicated they plan to adopt the ISSB disclosure standards, it is likely that the U.S. and E.U. will continue to push forward with their own climate and sustainability regulatory regimes. The U.S. Securities and Exchange Commission’s (SEC’s) climate disclosure requirements (still in proposal stage) are likely to be less stringent than the ISSB reporting requirements, whereas the E.U.’s current disclosure requirements, spearheaded by the European Financial Reporting Advisory Group (EFRAG), are currently more stringent.

In the E.U., compliance with EFRAG would still require additional disclosures beyond ISSB, lessening ISSB’s value as a “comprehensive” standard. In the U.S., due to a lack of current regulatory requirements, adoption of ISSB disclosures may be advantageous, as it could prepare companies and GPs to report to the SEC or LPs. ISSB has now imposed rigorous guidance around sustainability disclosures prior to the SEC doing so, meaning companies that align to ISSB could be prepared for forthcoming SEC regulation.

Challenges to ISSB Adoption

Due to the voluntary nature of the ISSB, ensuring its value as a standard that can consolidate sustainability disclosures requires buy-in from relevant stakeholders (e.g., companies, investors, regulatory regimes). As previously discussed, one major challenge in ISSB adoption is the more stringent disclosures required by markets in the E.U. The ISSB is still negotiating with different regulatory bodies (e.g., European Commission) to increase alignment across other frameworks. It is possible that disclosure standards will remain somewhat differentiated in the E.U.

In addition, reporting ISSB disclosure data may require significant effort for companies and GPs with immature ESG programs. While the ISSB disclosures include transition protocols on some of the most difficult and high-touch aspects, such as comparative data and Scope 3 emissions, gathering data can still be a significant lift for private companies. Difficulty in collecting across portfolio companies may act as a barrier to adoption for GPs. Conversely, because the ISSB has been built from existing frameworks, for companies that have already disclosed against a pre-existing reporting framework (e.g., SASB, TCFD, IIRC, CDSB), reporting in-line with ISSB should be more streamlined. Ultimately, prior disclosure commitments (e.g., side letters, public-facing commitments, signatory statuses) will complicate integrating ISSB for GPs and portfolio companies depending on the extent to which those commitments are in-scope of ISSB.

What ISSB Can Mean for General Partners

Despite some of the challenges ESG disclosure frameworks have posed, some investors are likely to be interested in ISSB requirements. Limited partners are indicating preferences for standardized sustainability disclosures to foster comparisons between GPs’ portfolios and understand pertinent climate and sustainability risks that affect investments in differentiated ways. Regulatory and investor pressure for comparable data and information disclosures from private market actors are combining to make sustainability disclosures an increasingly difficult priority for GPs to ignore.

Initiatives such as the ESG Data Convergence Initiative (EDCI) in private equity and the ESG Integrated Disclosure Project (IDP) in private debt illustrate widespread momentum to create a common data standard for reporting. Adoption of ISSB could enhance investment and exit opportunities for companies, as it would allow a broader group of stakeholders to interpret ESG risks. Adoption in other geographies (e.g., U.K., Canada, Japan, Singapore) could bolster interest in evaluating ISSB-aligned disclosures from GPs.

What General Partners Can Do Next

There are several actionable steps that GPs can take to prepare for alignment with standards like ISSB, including:

- Conducting a gap analysis of current external commitments (side letters, framework commitments, signatory statuses, etc.) to assess which frameworks (SASB, TCFD, etc.) the GP is currently reporting against and what overlaps exist.

- Assessing LPs regarding data and reporting interests to determine imminency of investor pressure to demonstrate alignment to a recognized framework.

- Measuring internal capacity to meet reporting requirements (either purely internally or with third-party support), both in the initial reporting year and on an annual basis moving forward.

The Future of IFRS Sustainability Disclosure

Throughout 2023, the ISSB is soliciting stakeholder feedback on future areas of prioritization, including biodiversity, human capital, and human rights. Thus, the standards could evolve over coming years. The IFRS maintains numerous international partnerships, including with the International Organization of Securities Commissions (IOSCO), the Financial Stability Board, and the Central Bank Governors of over 40 jurisdictions. It could leverage partnerships to amplify adoption of these standards and take a leading position in the competitive ESG framework landscape. Despite a lack of current regulatory requirements, U.S.-based companies and GPs should adopt ISSB disclosures in preparation for forthcoming SEC regulation.

Malk Partners does not make any express or implied representation or warranty on any future realization, outcome or risk associated with the content contained in this material. All recommendations contained herein are made as of the date of circulation and based on current ESG standards. Malk is an ESG advisory firm, and nothing in this material should be construed as, nor a substitute for, legal, technical, scientific, risk management, accounting, financial, or any other type of business advice, as the case may be.